Busignani explained that the purpose of the Annual Marketing study is to learn what is actually happening on the day-to-day level among marketers and advertisers; for example, what impacts their ability to measure outcomes and how they’re adapting and leaning into change. She knows firsthand how vital these actions are to marketers. Busignani is charged with working with them to help measure how well their marketing efforts are delivering ROI.

The study asked how more than 350 marketers across the globe perceive the effectiveness of using specific channels and the resulting actions, whether or not ROI measurement is clear, how they feel about specific channels, and whether the changes they’re seeing are also changing their role as marketers, Busignani explained. Additionally, the study explored how the role of the marketer has changed, with digital becoming a far bigger portion of spend and rivaling traditional channels.

One key finding confirmed how extensively the CMO role is changing. “The CMO is becoming a more technical role as the balance shifts [from traditional to digital spend],” Busignani said.

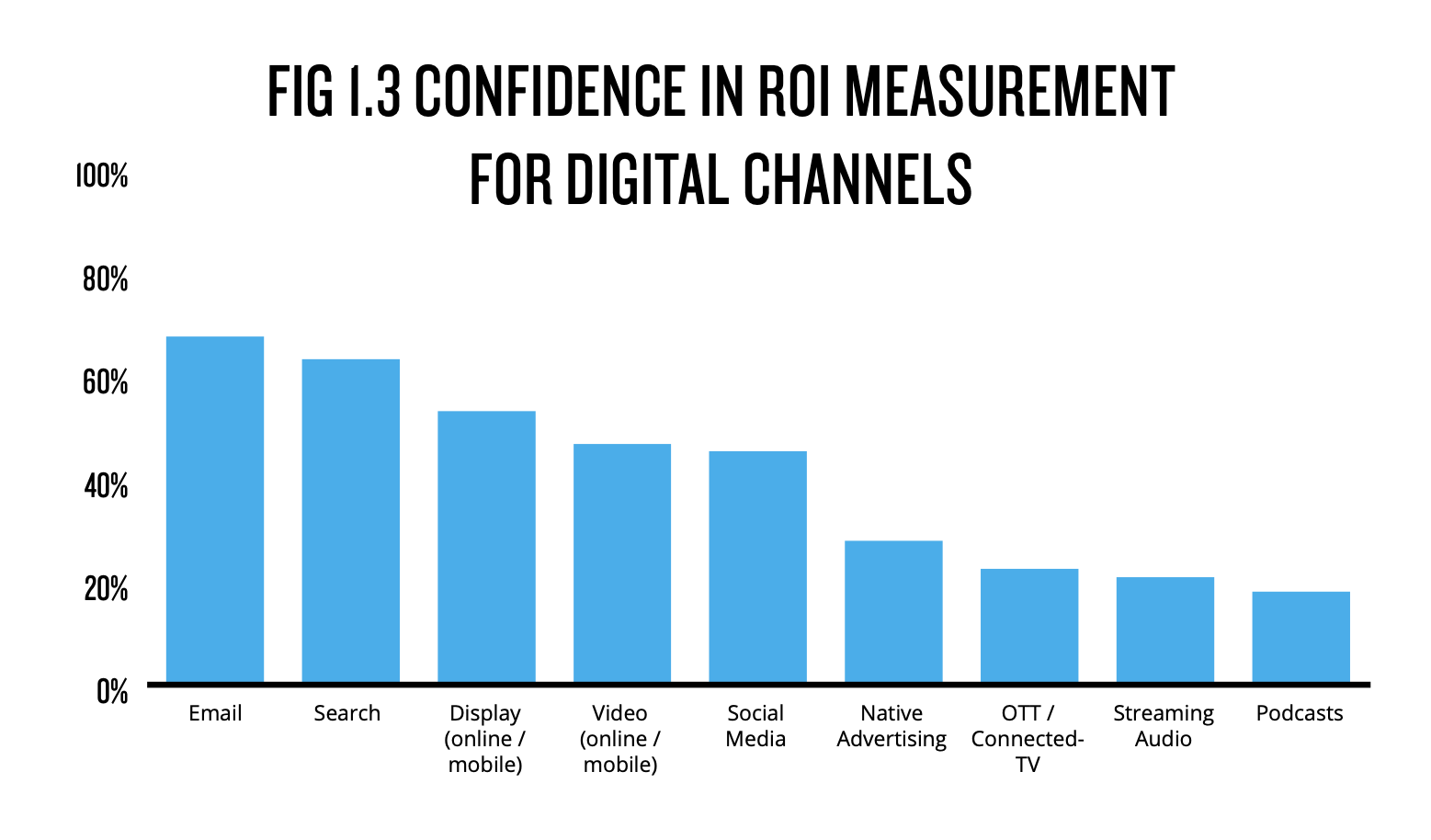

The study also found that marketers tended to give digital, “the benefit of the doubt,” in terms of investing more money into a platform regardless of the efficacy and clarity of the measurement. “New channels, new ad vehicles, new ways of engaging consumers, tend to spur investment without necessarily understanding resulting performance,” Busignani said. “There is a willingness to invest in advance of true measurement and accountability because they are new channels.” But, she warned, a day of reckoning is coming, where marketers realize that they need more accountability to justify their investments.

Busignani saw the related disconnect between spend and results in the study’s finding. She explained that marketers often rely on a particular, familiar channel — such as email or search — without actually having metrics that accurately assesses whether it is delivering on the goal. The report revealed that marketers sometimes assess the effectiveness of the media mix by relying on their perceptions alone for performance success. And, she added, marketers are increasing these investments despite the lack of adequate measurement.

With digital now representing more than half of all ad spend in the U.S., basing results on perception alone is a risky venture. “Accountability has arrived. Digital publishers are interested in measurement to increase the value of their audience,” Busignani said.

Traditional channels are also interested in proving their value to marketers in this increasingly fragmented ecosystem. “As the fight for ad dollars continues, data and concrete measurement are a battleground for both digital and traditional,” she said. “And, consumers need to benefit in a privacy-compliant way.”

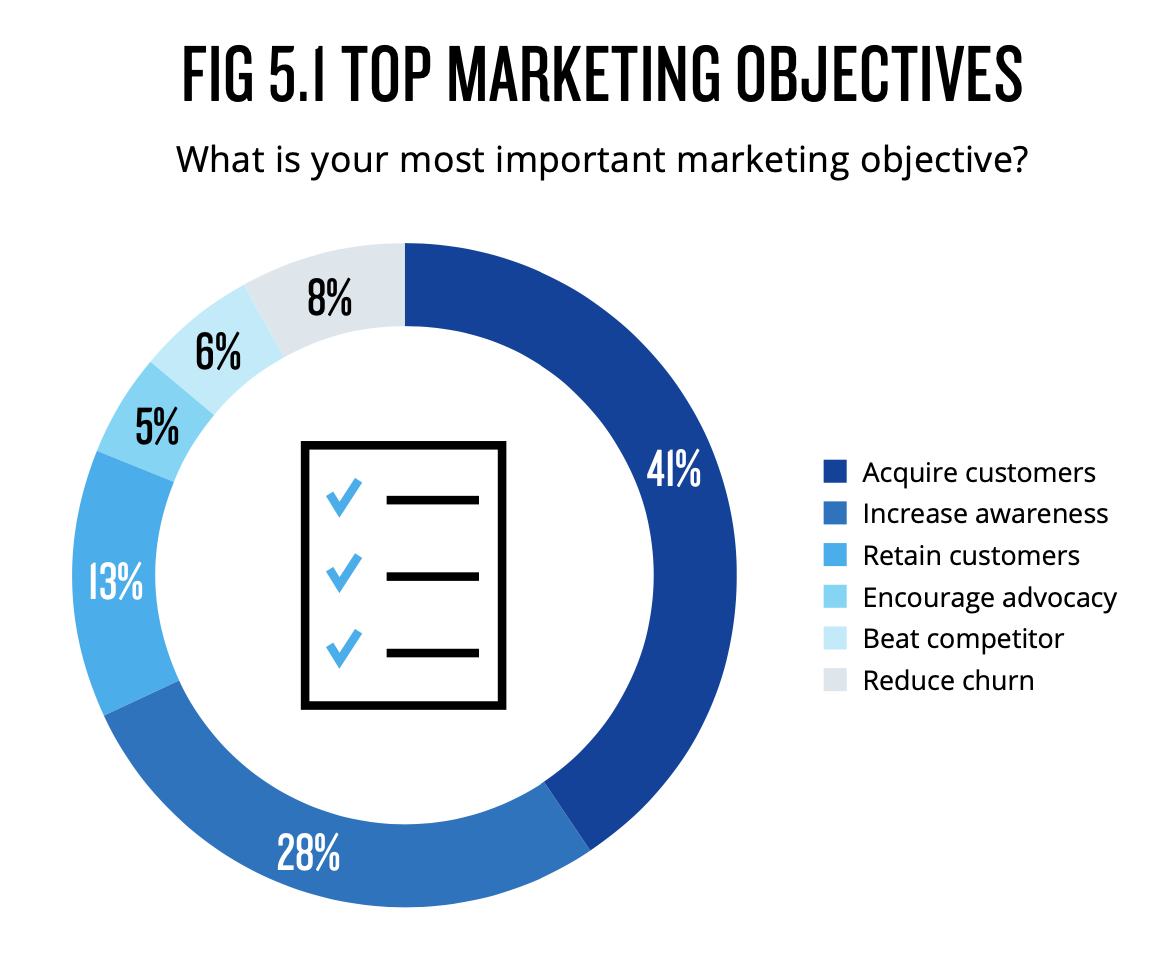

One of the unexpected results from the study is that marketers are shifting their priorities. Forty-one percent of marketers said that acquiring new customers is the most important goal. “Marketers are focused on acquiring new customers, rather than focusing on retention and reducing churn,” Busignani said. Compared to last year’s study, she added, the pendulum has not yet swung back to a balance between acquisition and “ensuring engagement with your existing client base and preventing churn.” But she is confident that the priorities will, “start to shift back, with more balance between customer acquisition and retention and engagement with current customers.”

At the same time, brand awareness also was a lower priority than customer acquisition. The risk, she warned, is that “we have neglected brand building and brand engagement.” Busignani recommends that advertisers and marketers take the time to fully understand the long-term effects of brand building on both acquisition and retention.

Nielsen is committed to helping the industry navigate these changes, supporting and informing all priorities, Busignani pointed out. “We have a rich history in measurement,” she said, “serving a role in the marketplace around understanding audiences, as well as helping advertisers understand what they are getting for their investment and helping media demonstrate the value of their audiences.” When you can offer all of those solutions, it is only a matter of time before the Age of Dissonance becomes the Age of Harmony.

The full report on Nielsen's Annual Marketing study is available here.

No comments:

Post a Comment